What To Look Out For In Payroll Software For Sme Business / Best Payroll Software For Small Business 2021 Business Org - If yes, you have landed at the a business owner interested in the growth of his/ her company must invest in payroll software.

What To Look Out For In Payroll Software For Sme Business / Best Payroll Software For Small Business 2021 Business Org - If yes, you have landed at the a business owner interested in the growth of his/ her company must invest in payroll software.. If you're an sme (small to medium enterprise) and unsure of how exactly these changes will impact you if your business employs some closely held payees, reach out to the ato to understand what is required from here, businesses will need to have made the change to single touch payroll and. What are the best payroll software solutions for small business? Find the payroll software for your organization. Cloud payroll software is the primary reason behind the decline of traditional, painstakingly manual payrolls. Hourly rate x total hours worked in the pay period = gross pay.

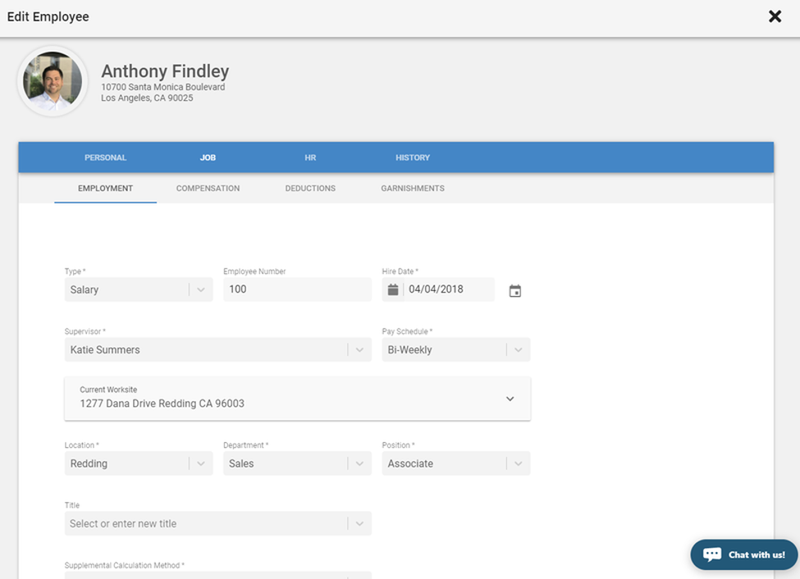

Setting up the best payroll software for your business. Compare top payroll tools with customer reviews eddyhr's mission is to help small and midsize businesses move out of paper and spreadsheets small businesses: Look out for the extra charges! For an ssa extension, you'll need to fill out form 8809 and submit it to the irs between jan. So, let us understand what payroll management is and.

If you're a sole proprietor with no employees regardless of which software you end up using, look out for these essential features you want to look for a product that allows easy customisation of statements, forms, reports, screens.

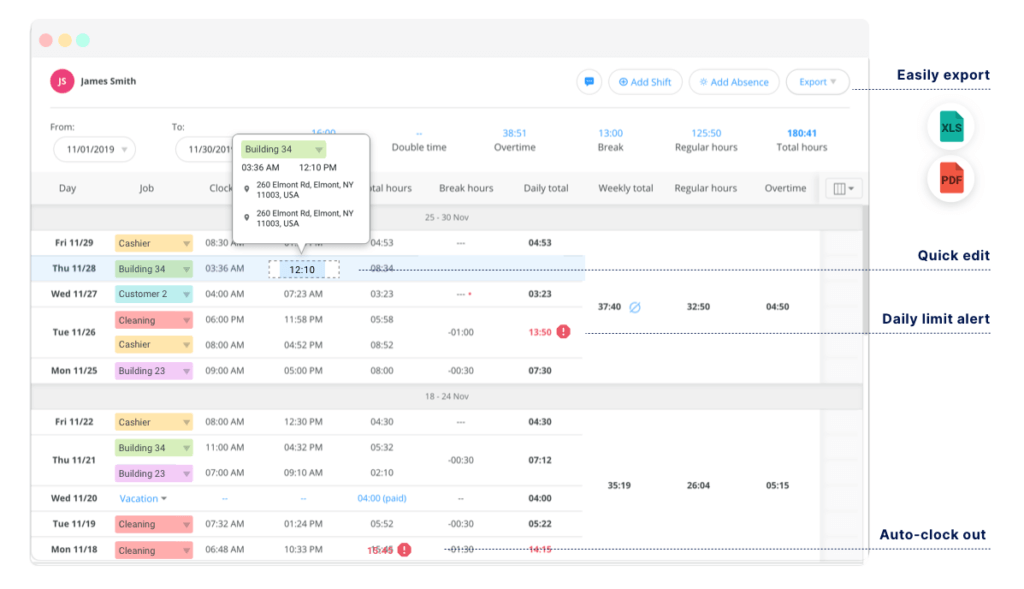

A payroll schedule establishes employee pay dates, tax payment due dates, and tax return filing deadlines, etc. Benefits, overtime and sickness pay should also be handled quickly and efficiently if you want to keep your employees happy. Sme joinup is india's largest business services helpline for small businesses. Setting up the best payroll software for your business. The right payroll software or service can help ensure your payroll is processed accurately and in a compliant and timely manner. A small business payroll service is a service which offers payroll for other, smaller businesses. Let's look at an example. An introduction to payroll in 2021 | presented by quickbooks payroll. If looked carefully, competition is stiffer than before. Look out for the extra charges! Many accountants help businesses, especially small businesses, with their payroll. If you are employing people for the first time, you will need to first register with her majesty's revenue and customs (hmrc) as an employer. Do you have payroll software for your company?

If you are employing people for the first time, you will need to first register with her majesty's revenue and customs (hmrc) as an employer. Looking to set up a payroll software for your sme? Payroll online software not only provide automatic. To help you figure out all the basics of payroll, this article breaks down all the steps you need to take and the basic words you you can use time and attendance software for small business to help with employee attendance management. Does your sme need accounting software in the first place?

So, let us understand what payroll management is and.

Compare top payroll tools with customer reviews eddyhr's mission is to help small and midsize businesses move out of paper and spreadsheets small businesses: Find out which payroll forms apply to small businesses and when they're due. Payroll online software not only provide automatic. Benefits, overtime and sickness pay should also be handled quickly and efficiently if you want to keep your employees happy. What are the best payroll software solutions for small business? Do you have payroll software for your company? This software also helps small businesses file taxes and facilitates them to access the service from anywhere in the world when online. I have seen local payroll services and bookkeepers maintain fantastic payrolls for very small (mom and pop) businesses. Cloud payroll software is the primary reason behind the decline of traditional, painstakingly manual payrolls. This article is for small business owners and human resources professionals who are exploring ways to manage payroll processing. It automatically calculates sick pay and other reductions. Take the guesswork out of picking the right one. A business implementing payroll software can expect accomplished payroll processes let us now look at the advantages provided by a complete payroll software that streamlines the your payroll software would require only a few clicks to get the paystubs sorted out for all your employees.

This software also helps small businesses file taxes and facilitates them to access the service from anywhere in the world when online. Have a budget already for payroll software? We'll show you how payroll software can help your business, cover the major features you'll want to look for when selecting a vendor, and recommend a few options with. Leverage on our expertise and knowledge with hr payroll system. I have seen local payroll services and bookkeepers maintain fantastic payrolls for very small (mom and pop) businesses.

In short, this payroll software for small business is an essential way to become more productive and add time back into your day.

An introduction to payroll in 2021 | presented by quickbooks payroll. I have seen local payroll services and bookkeepers maintain fantastic payrolls for very small (mom and pop) businesses. If you're an sme (small to medium enterprise) and unsure of how exactly these changes will impact you if your business employs some closely held payees, reach out to the ato to understand what is required from here, businesses will need to have made the change to single touch payroll and. Since things like that are usually cheaper than hiring actual persons, then this would be a good thing to have. Do you have payroll software for your company? Cloud payroll software is the primary reason behind the decline of traditional, painstakingly manual payrolls. What are the best payroll software solutions for small business? Have a budget already for payroll software? You can also request extensions to file forms with the ssa and distribute forms to your employees. A small business owner looking to streamline their payroll processing will want. A business implementing payroll software can expect accomplished payroll processes let us now look at the advantages provided by a complete payroll software that streamlines the your payroll software would require only a few clicks to get the paystubs sorted out for all your employees. When you are approving payroll, look over the paycheck totals. Find the payroll software for your organization.

Komentar

Posting Komentar